As the push for decarbonization and cleaner energy solutions continues, electric vehicles (EVs) are often heralded as the cornerstone of a green future. Yet, despite environmental awareness and technological advancements to combat climate change, a significant portion of the American public remains skeptical — even hostile — toward transitioning from gasoline to electricity.

The reasons for such hesitancy are diverse, ranging from concerns over charging infrastructure and range anxiety to a deep-seated attachment to traditional gas-powered vehicles. Yet, just how deep does this attachment run, and what would it truly take to convince most Americans to embrace an EV?

As the Internet of Things (IoT) increasingly intertwines the automotive industry, data security increasingly becomes integral to vehicle operations. The connection between EV adoption and data security is crucial, especially as the Biden-Harris administration pushes for stronger vehicle pollution standards and the development of EV infrastructure. This shift could soon redefine the automotive landscape, making data security even more of a key consideration for potential EV buyers.

That’s why the Secure Data Recovery team set out to explore the current attitudes toward EV adoption in the U.S. We conducted a comprehensive survey of over 2,000 Americans who do not currently own an EV. Our findings delve into the heart of American EV hesitation. We uncover the psychological and practical barriers that must be overcome in addition to the incentives that would ignite widespread EV adoption.

Key takeaways

- 30% of Americans would decline a free EV.

- 61% would buy an EV if charging matched gas station availability.

- Only 10% plan on buying an EV, but 58% would buy one if the range lasted 1,000 miles/charge.

- The highest income earners are no more likely to buy an EV than the lowest income earners.

Understanding the EV Roadblocks

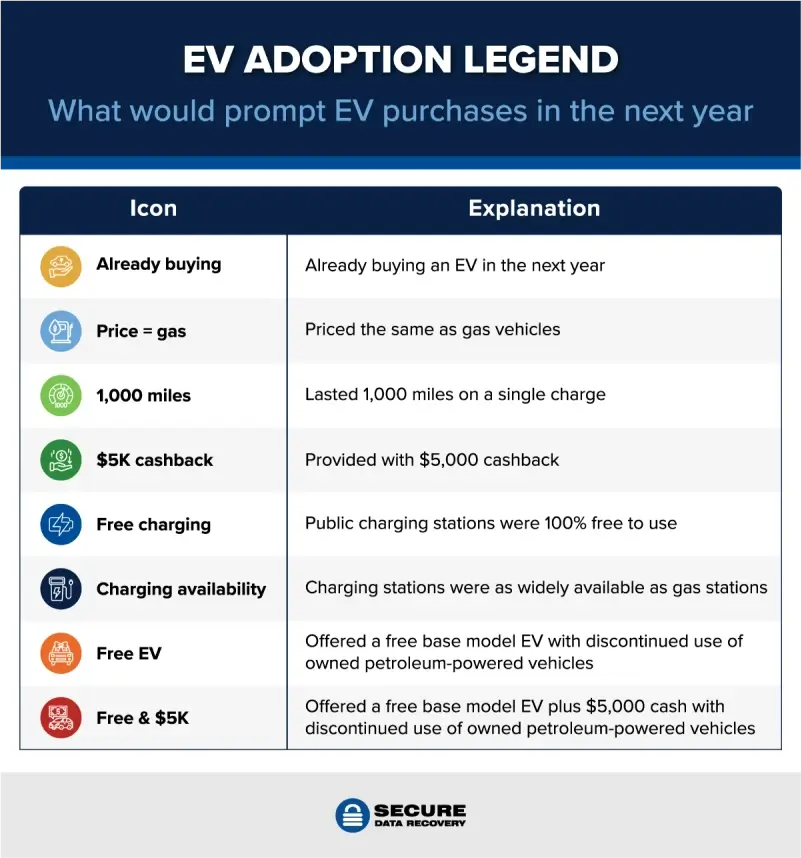

There are many barriers and incentives that influence American attitudes about EVs. Here is a quick guide for understanding the specific thresholds that are referenced throughout this article. Each of these thresholds represents the various conditions that might influence an American to choose to adopt an EV. The legend below serves as a key for this article, with full explanations for each threshold and the simpler terms referenced throughout the rest of this study.

The Trigger for America’s EV Shift

So, what would it take to trigger a widespread shift toward EVs in the U.S.? Our explorations discovered that there is no one-size-fits-all solution. Many Americans need specific obstacles removed before they consider an EV purchase. For others, additional incentives are required. However, extraordinary incentives are necessary to reach a supermajority of EV adoption in the country.

The most surprising finding in our study is that even a promise of a free EV would still leave many Americans unwilling to switch. A full 30% would decline the offer of a completely free EV. As if this was not shocking enough, even when adding in the bonus of $5,000 cash in addition to a free EV, 19% of Americans would still refuse the offer.

Both propositions were on the condition that those who accepted would not be able to use any petroleum-powered vehicles they owned. Still, these findings highlight the deeply ingrained skepticism Americans have about EVs or the attachment many have to traditional vehicles.

However, the landscape is not completely dire. Our findings reveal that many Americans are ready to make the leap to EV if just a couple of kinks are worked out. In fact, the promise of a free EV is not required to incentivize most to make the switch. A true 64% supermajority of Americans would buy an EV within the next year if public charging stations across the country were made free to use.

Even when we remove anything free from the equation, most Americans still are ready to switch if the infrastructure is truly ready. A full 61% said they would buy an EV within the next year if charging stations were as available and widespread as gas stations in the country. Another 58% said they would buy an EV if its charging range lasted 1,000 miles per charge. These findings highlight the progress that many view as a requirement before they take the leap to go fully electric.

For comparative purposes, only 10% of those surveyed said they already plan on buying an EV within the next year, given the current EV market and infrastructure conditions. However, that finding jumps to 40% who said they would buy an EV if the cost were about the same as that of an average gas-powered vehicle.

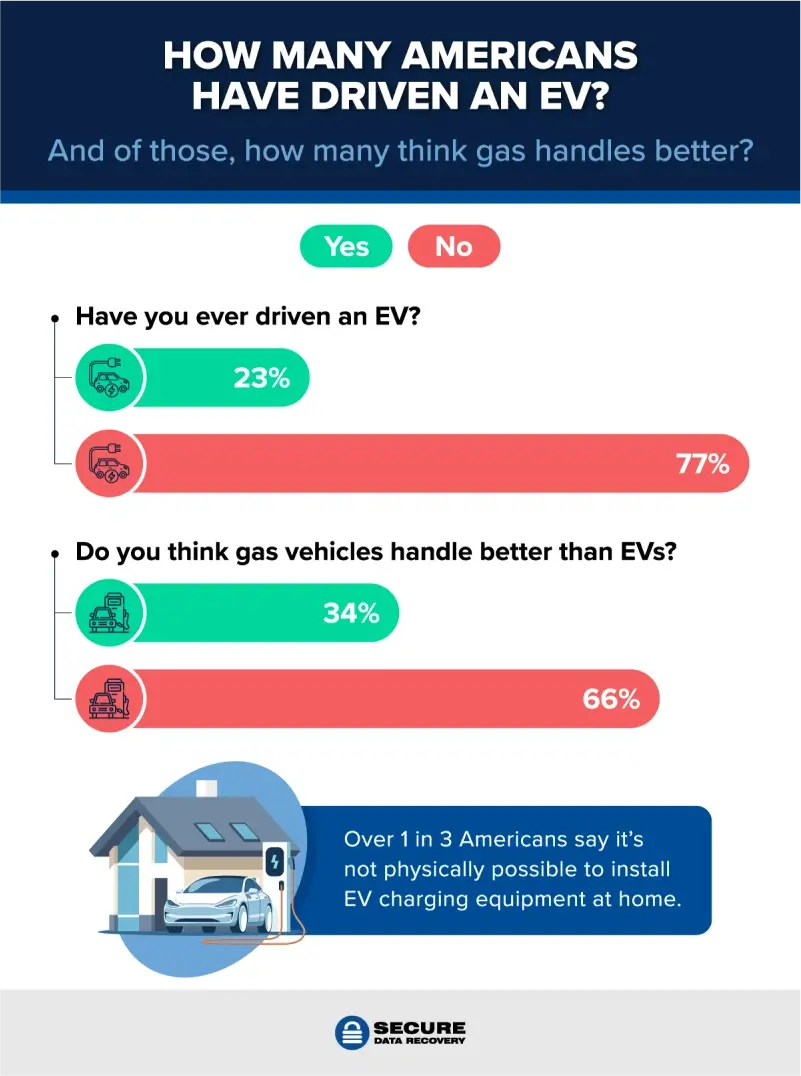

Another crucial element that we explored was Americans’ experiences driving an EV. It’s natural to resist change, and while a full immersion is often seen as a way to overcome the fear of the unknown, our survey challenges that notion.

According to our survey, only 23% of Americans have ever driven an EV, of those who do not currently own one. Of everyone surveyed — EV experience or not — 32% said they don’t trust EVs to operate as safely as gas vehicles. Then, of those with EV experience, 34% said they think gas vehicles handle better.

These reservations are despite the fact that EVs must meet the same safety standards as petroleum-powered vehicles. Just like conventional cars, EVs must also meet the Federal Motor Vehicle Safety Standards undergoing vast, well-established testing. In addition, EV batteries also have stringent safety and testing standards.

These findings suggest that simply experiencing an EV may not be enough to dispel many concerns. In fact, the similarity in skepticism between all respondents and those with EV experience highlights the deeper reservations Americans hold about making the switch. As the country continues to push for wider EV adoption, addressing these underlying doubts will be just as important as improving infrastructure and incentives.

What Would Drive EV Adoption Across Ages and Incomes

The willingness to adopt EVs varies across age groups but notably less so across income brackets, which defies conventional expectations. For instance, it would be understandable to assume that the highest income earners are more likely to purchase an EV, requiring fewer incentives. Still, our data shows this is not necessarily the case.

In fact, across the whole survey, Americans making over $150,000 are only 1% more likely to express willingness to buy an EV compared to those earning under $25,000. Since this finding is within the margin of error, the lowest-income earners may actually be more willing to adopt EVs.

The most notable difference between income brackets is our finding that Americans earning between $85,000 and $100,000 are most likely to already plan on buying an EV within the next year. A full 19% of this income group said they don’t need any obstacles removed or incentives offered to make this purchase.

Nevertheless, these findings suggest that financial capability is far from the primary factor driving or hindering interest in EVs. Particularly when we consider that 30% of Americans would reject a free EV given to them, other concerns such as performance and infrastructure likely play far more significant roles across all income levels.

Age is a more critical factor in willingness to switch to EVs. Across the entire survey, young adults between the ages of 18 and 26 are 17% more likely, on average, to say they would buy an EV within the next year compared to older adults between the ages of 59 and 77.

When we examine age differences between specific incentives, we find even larger differences. Young adults between the ages of 18 and 26 are 25% more likely than older adults ages 59 to 77 to buy an EV within the next year if public charging is made freely available. These same young adults are also 28% more likely to buy an EV with $5,000 cashback than their older American counterparts.

The States Most Ready to Embrace EVs

Geographically, readiness to adopt EVs varies by state rather dramatically. Many factors influence regional readiness, including local infrastructure, attitudes, and state-level platforms. For example, the state often seen as the leader in green initiatives — California — has the highest proportion of residents already planning on buying an EV within the next year.

When considering the fact that California has the most charging infrastructure in the country, it makes sense that the state has the highest proportion of residents already planning to buy. Still, only 1 in 4 Californians plan to buy an EV within the next year. However, a key question reveals that infrastructure plays a large role in that finding. A whole 85% of the state would buy an EV within the next year if public charging stations were free to use.

Other notable responses to the hypothetical removed thresholds of EV adoption include the state of Georgia. An overwhelming 79% of the state said they would buy an EV within a year if charging stations were as widespread and available as gas stations. No other state showed as much interest in switching to EVs from removing this barrier as Georgia.

Interestingly, Massachusetts had the highest response rate in terms of willingness to accept an EV freely given to them. A whole 83% of this state would take that deal. That would leave significantly fewer petroleum-powered vehicles on the road, instantly making them the leader in EV adoption.

In the arguably less intensive incentive hypothetically offered in our survey — the $5,000 cashback — Maryland residents were the most responsive. Nearly 4 in 5 residents would buy an EV in the next year if it came with a $5,000 cashback incentive. Considering that the average price for a new EV is $56,520, it’s clear that Maryland is one of the states most easily influenced by financials when it comes to switching to an EV.

Not every state with notable responses stood out for optimistic reasons. In Idaho, 35% of residents would reject the free EV offer, even if it came with a bonus of $5,000 in cash. No other state was as opposed to this hypothetical offer.

The landscape of EV readiness across the U.S. and the barriers that need to be overcome or incentives offered vary dramatically by state. Some, like California, Texas, and Mississippi, lead with the highest proportion of residents already planning to buy an EV.

Other states like Virginia, New Jersey, and Maine respond more to lifted barriers. Many states, like Utah, Indiana, and Nebraska, respond well to incentives for EV purchases. Finally, some states like South Carolina, Wisconsin, and Oklahoma will require the much more difficult task of winning over hearts and minds.

Protect Your Data Now and in the Electrifying Future

As the push towards EV adoption continues, the importance of protecting digital assets becomes more critical than ever as more of our lives become increasingly dependent on reliable data solutions. Whether it’s navigating an onboard EV system or managing your personal and professional data, the increasing importance of secure and accessible information cannot be overstated.

Secure Data Recovery is here to help. We understand the value of your data and the paramount importance of keeping it safe. Our industry-leading data recovery services, including hard drive recovery, SSD data recovery, and RAID recovery services, ensure that your life-critical data remains secure and accessible, no matter where the road may take you.

Methodology

Between August 8–10, 2024, we surveyed 2,011 Americans who did not already own a fully electric vehicle (EV) by state, asking a variety of questions about their obstacles to buying a fully electric vehicle (EV).

We identified common barriers to buying an EV and asked Americans if they would buy an EV within the next year if each barrier were removed. In our survey, we increasingly lowered the threshold with each question in an attempt to find the threshold that most Americans would say they would buy an EV within the next year if a certain obstacle were removed.